How do I file Form 1120-POL with Tax990?

Follow the steps below to file Form 1120-POL with Tax990.

Step 1: To file a 990 return to the IRS, you must create or add an organization to your account, or you can select from the dropdown if the business already exists.

Step 2: You can check the applicable box for special cases. Once selecting the Tax Year, Click ‘Next’.

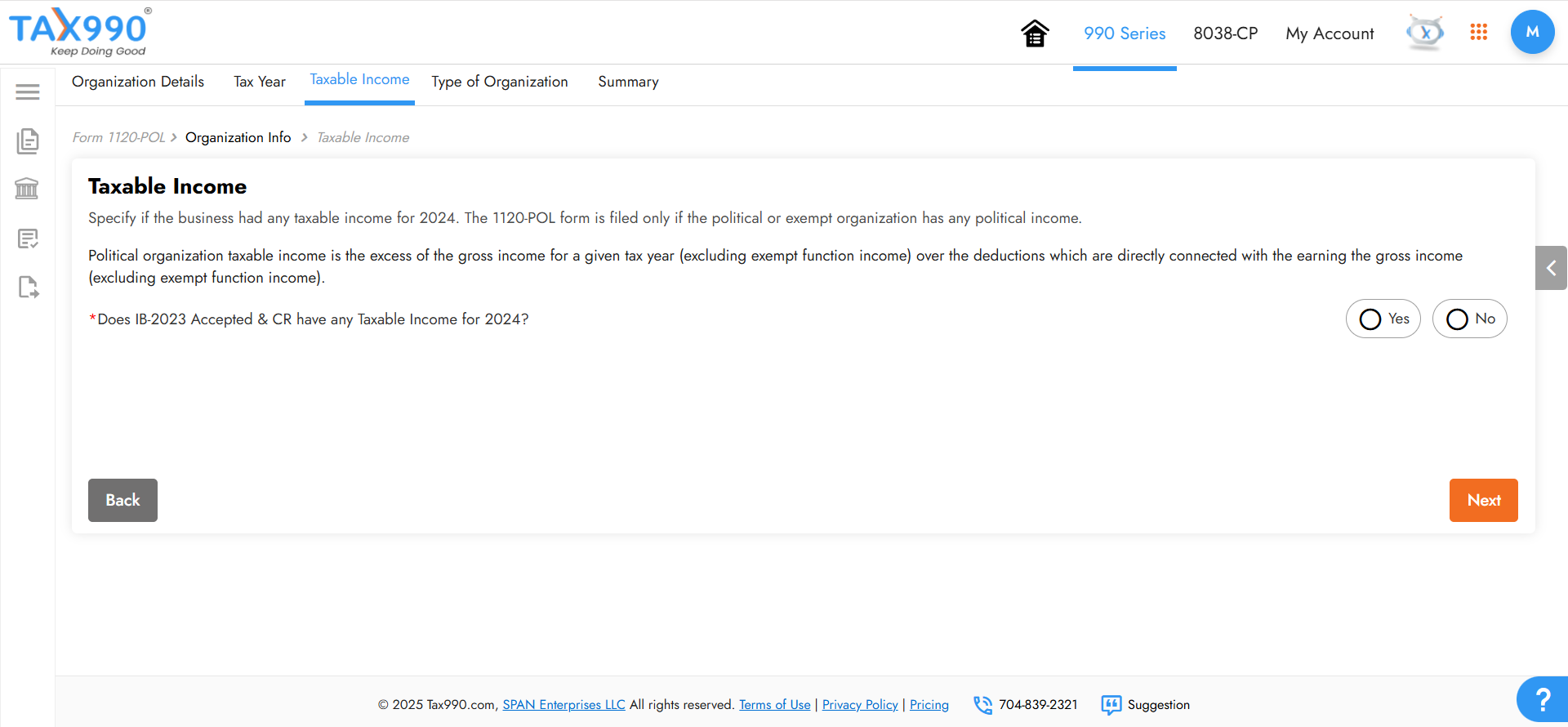

Step 3: Choose the options for Taxable Income and click ‘Next’.

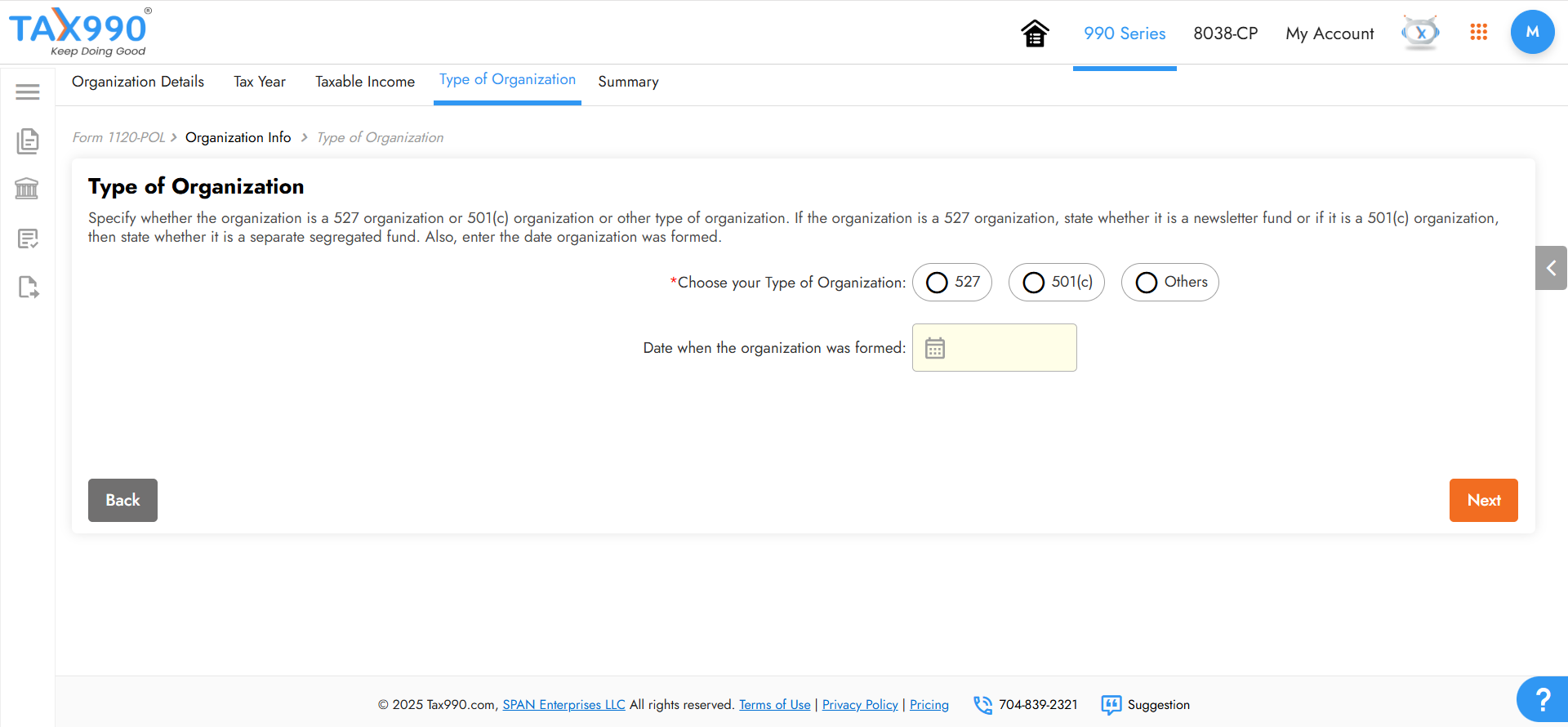

Step 4: Select the type of organization and enter its details. Click ‘Next’.

Step 5: Enter the details for your political committee and click ‘Next’.

Step 6: Review the information you provided and click ‘Next’ to proceed.

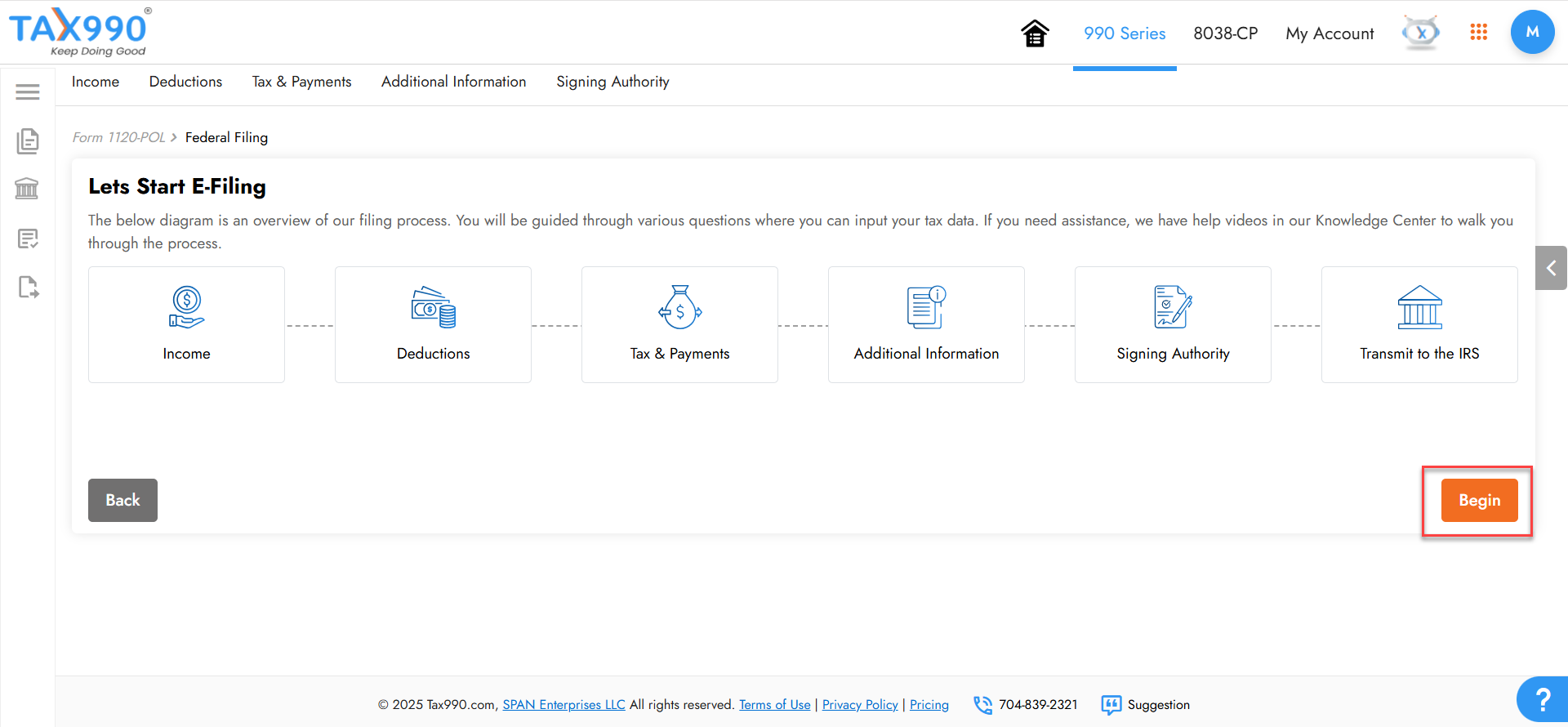

Step 7: Start E-filing Form 1120-POL by clicking the ‘Begin’ button.

Step 8: Click ‘Start’ next to relevant sections and provide the required details, and you can edit them if needed. Then, click ‘Next’ to proceed.

Step 9: Preview the Form 1120-POL information you provided for federal filing and click ‘Continue to Audit’.

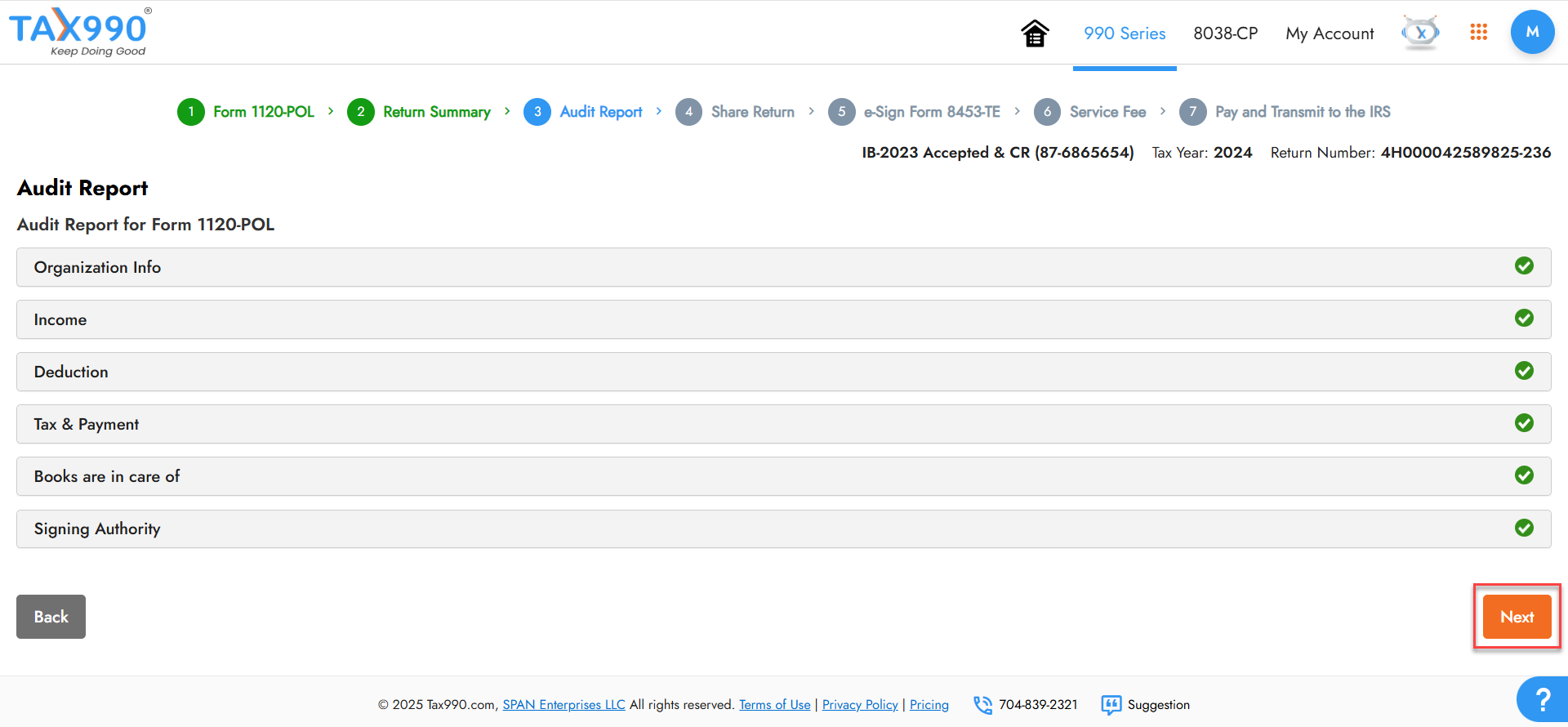

Step 10: Check the review report and fix error if anything exist. Click ‘Next’ to proceed.

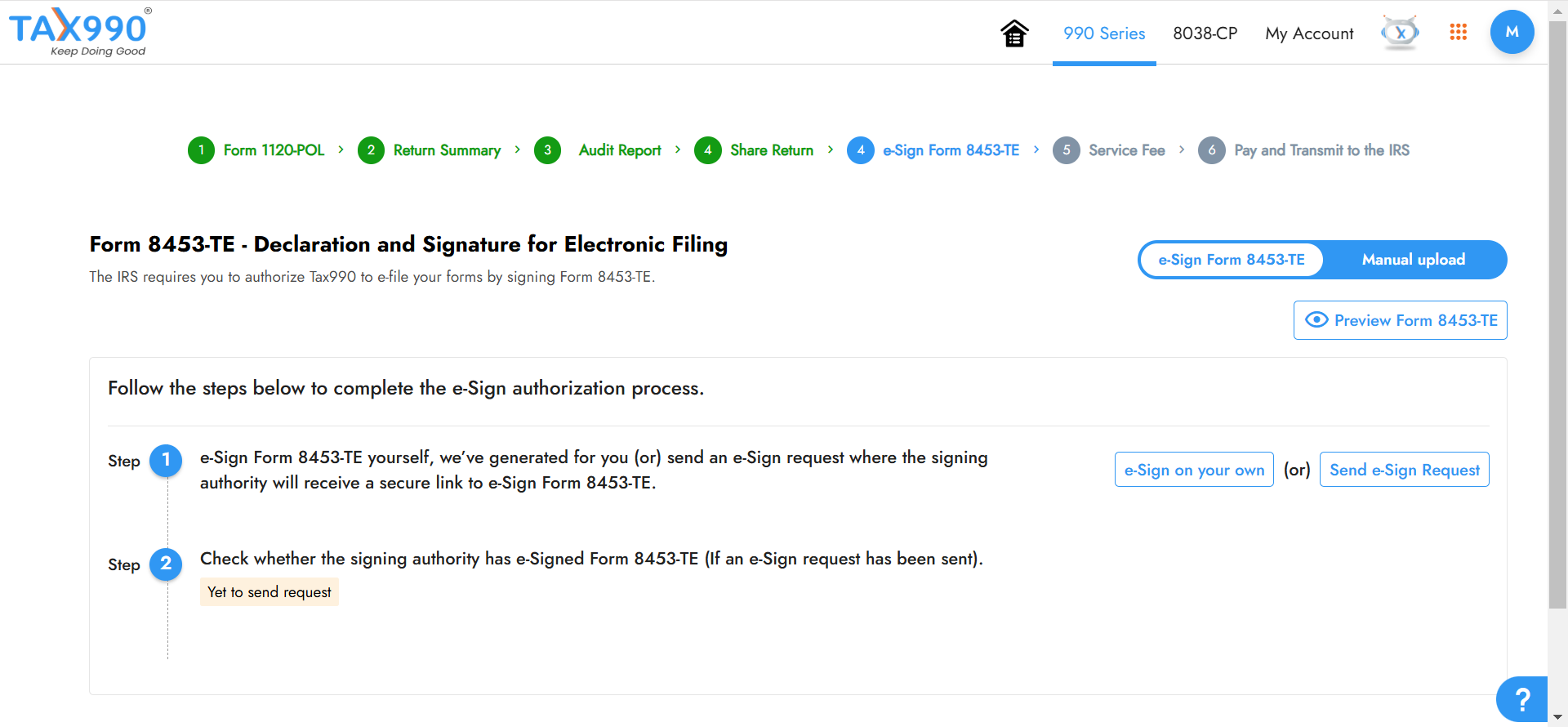

Step 11: Provide the electronic signature or get it from the signing authority and click ‘Transmit to the IRS’.

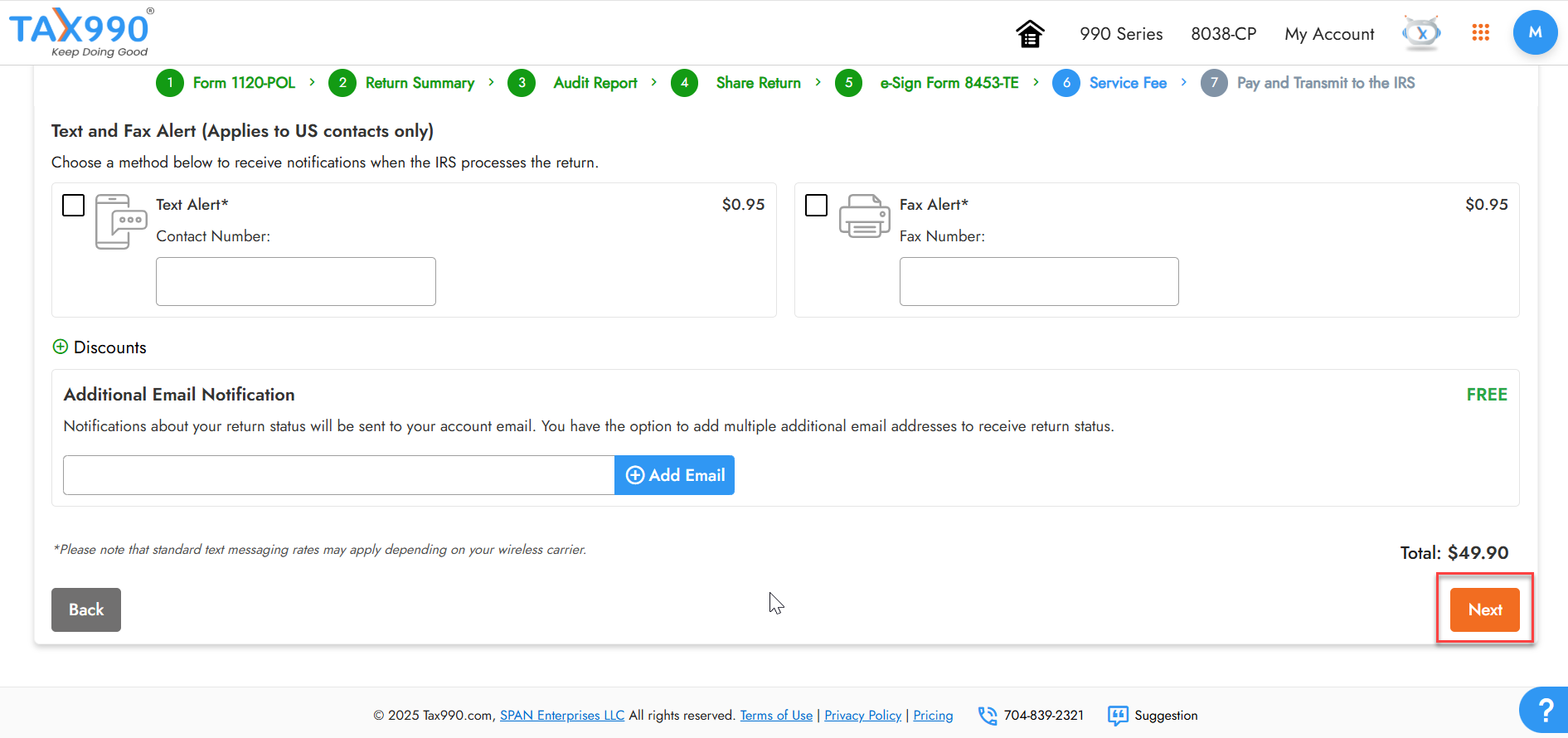

Step 12: You can add the contact and Fax number to receive alerts. Then, click ‘Next’ to proceed.

Step 13: Once done, your form will be successfully transmitted to the IRS.

Need more help?

Get in touch with our dedicated support team Contact Us