How do I file Form 990-N with Tax990?

Follow the steps below to file Form 990-N with Tax990.

Step 1: From the Tax990 website, enter your organization’s EIN in the search box and click ‘Search’.

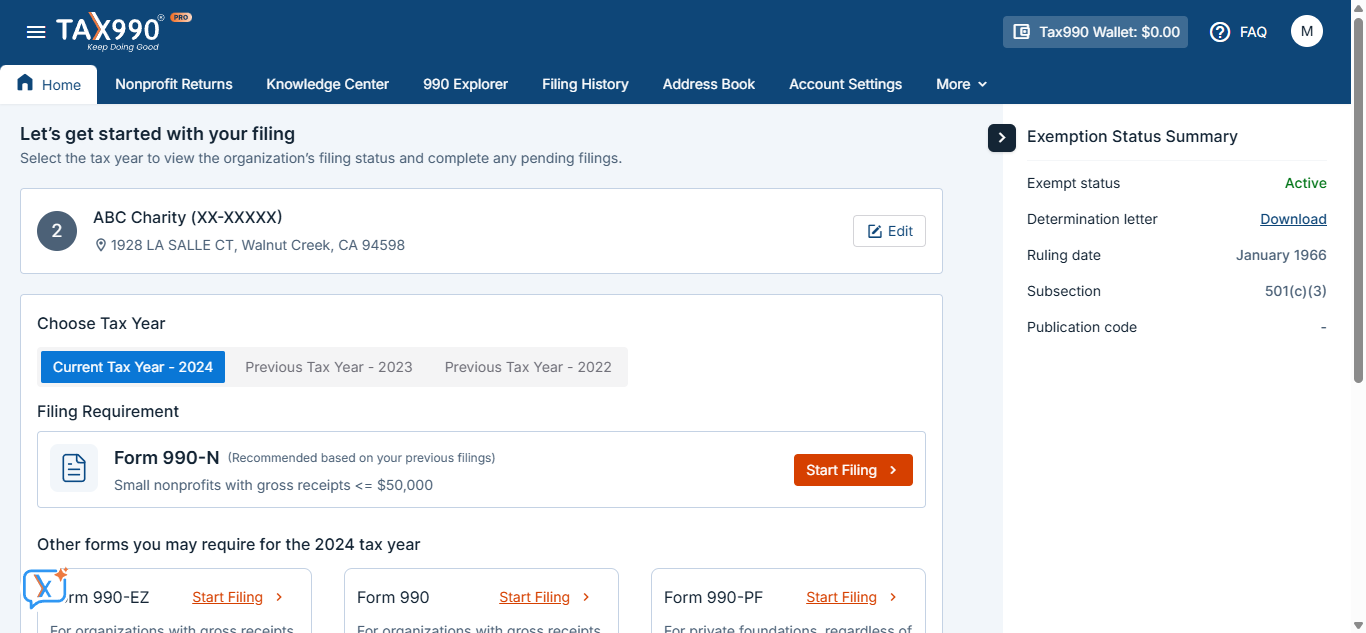

Step 2: You can find the organization’s details and the filing status of the EIN you’ve searched for (fetched from the IRS). Click ‘Start Filing’ to begin filing a new 990-N return.

Step 3: Now, you’ll be prompted to log in or sign up. Enter your credentials to log in if you have an existing account, or create a new one to continue filing.

Step 4: Then, you can select the tax years you need to file for and click ‘Start Filing’.

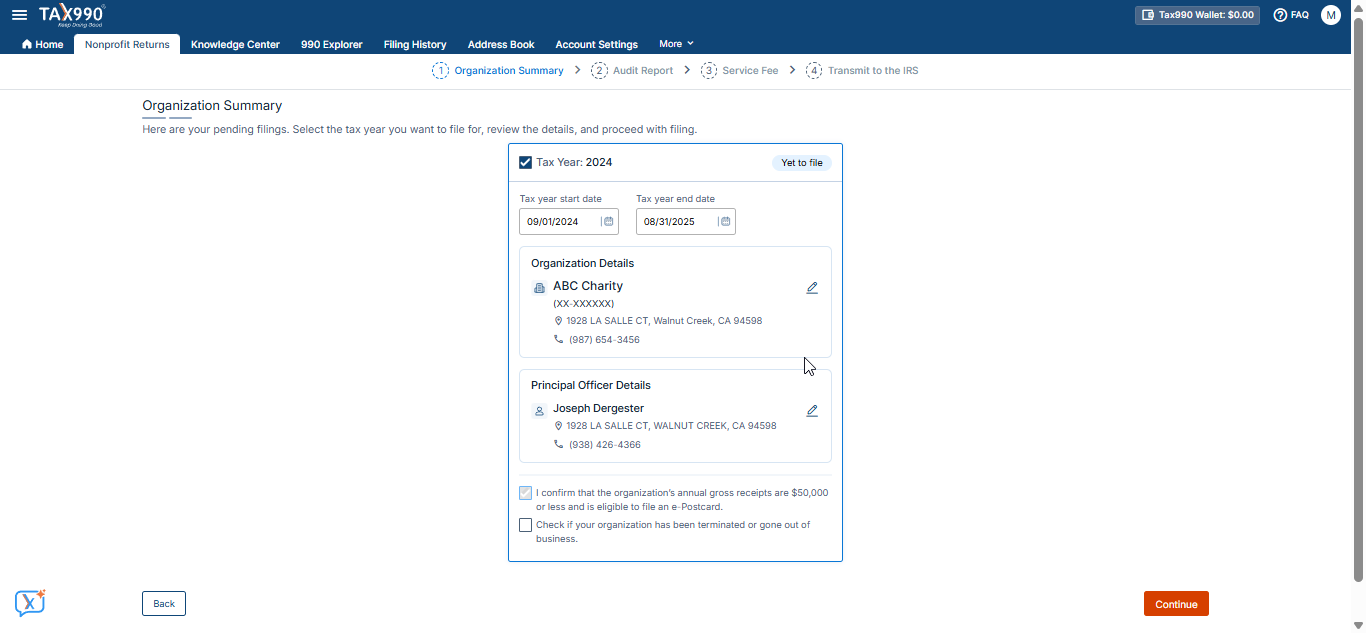

Step 5: Review the organization details, edit them as needed, and click ‘Save’ to proceed.

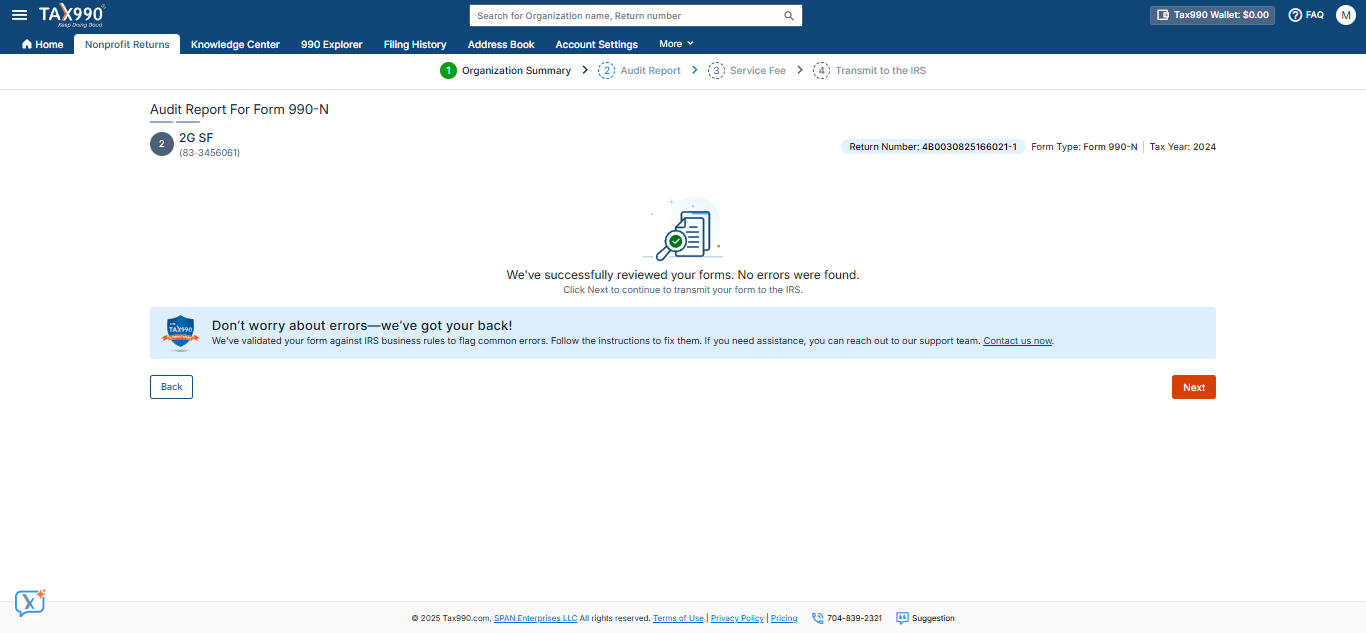

Step 6: Once you’ve completed the form, you will be directed to the Audit Report page. Here, you can check for any errors in your submission. If any issues are identified, click ‘Fix Error’ to address the errors. Once you’ve made the necessary corrections, click ‘Next’ to proceed.

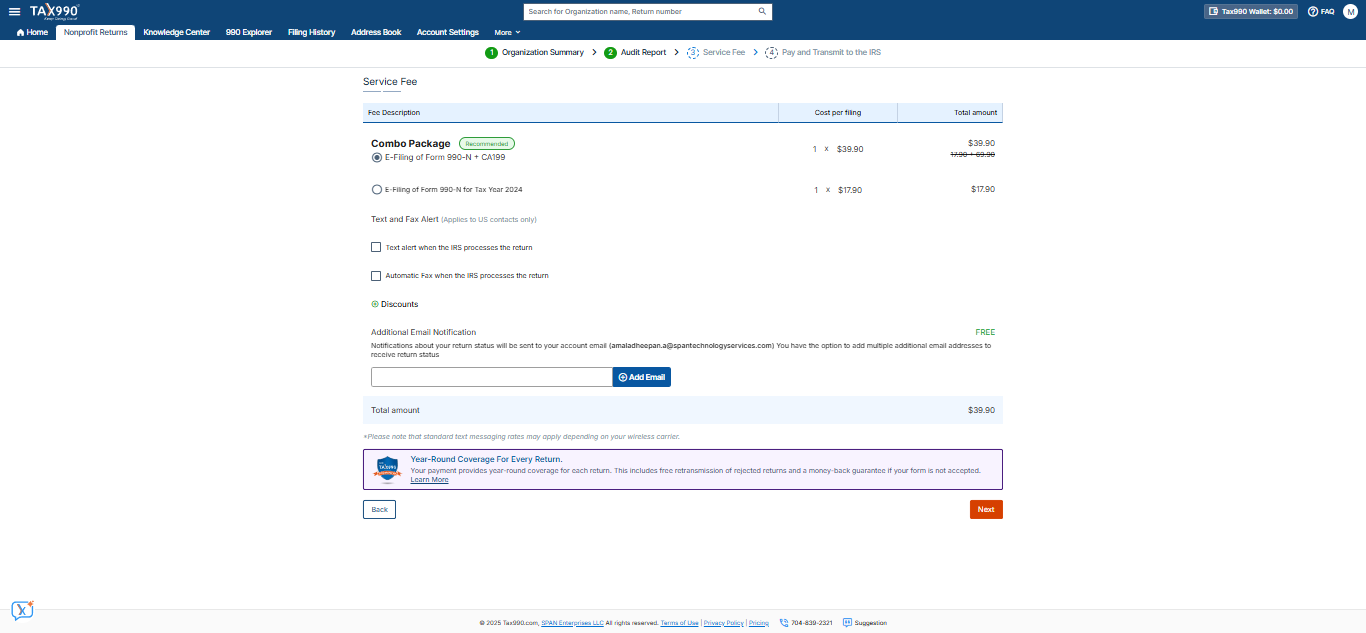

Step 7: You can add optional text and fax alerts for when the IRS processes the return. Then, click ‘Next’ to proceed.

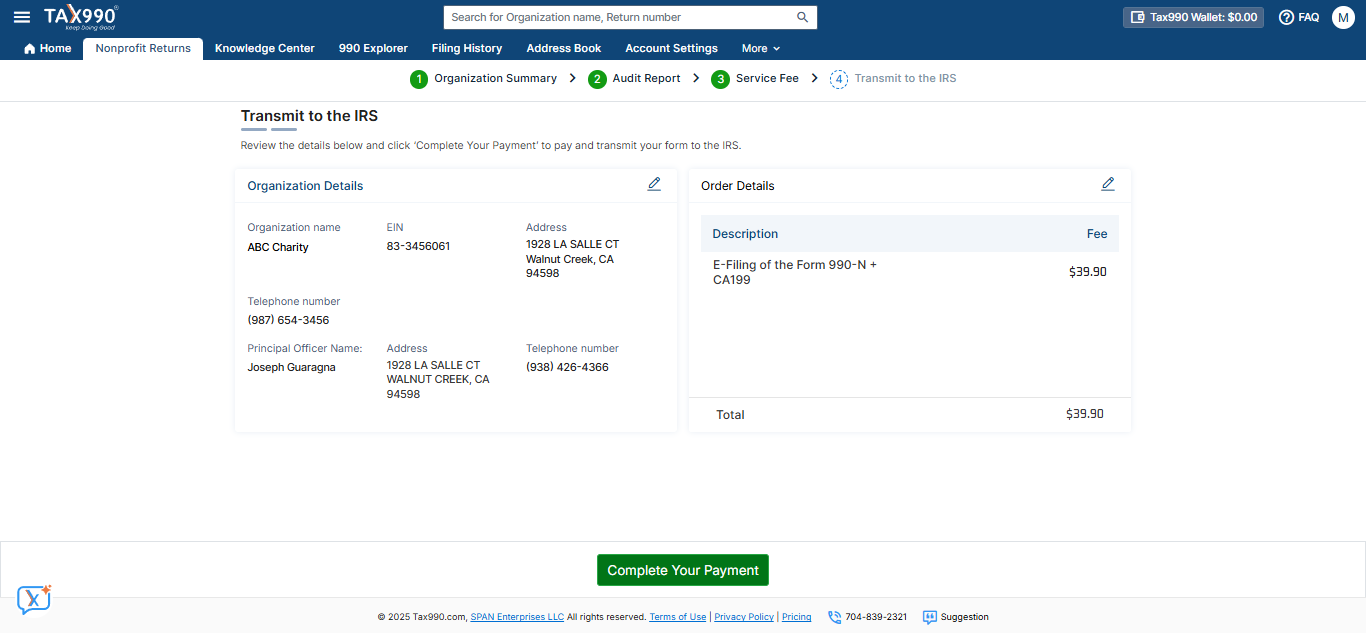

Step 8: Review the final summary of your Form 990-N and edit the details if needed. Click ‘Complete Your Order’.

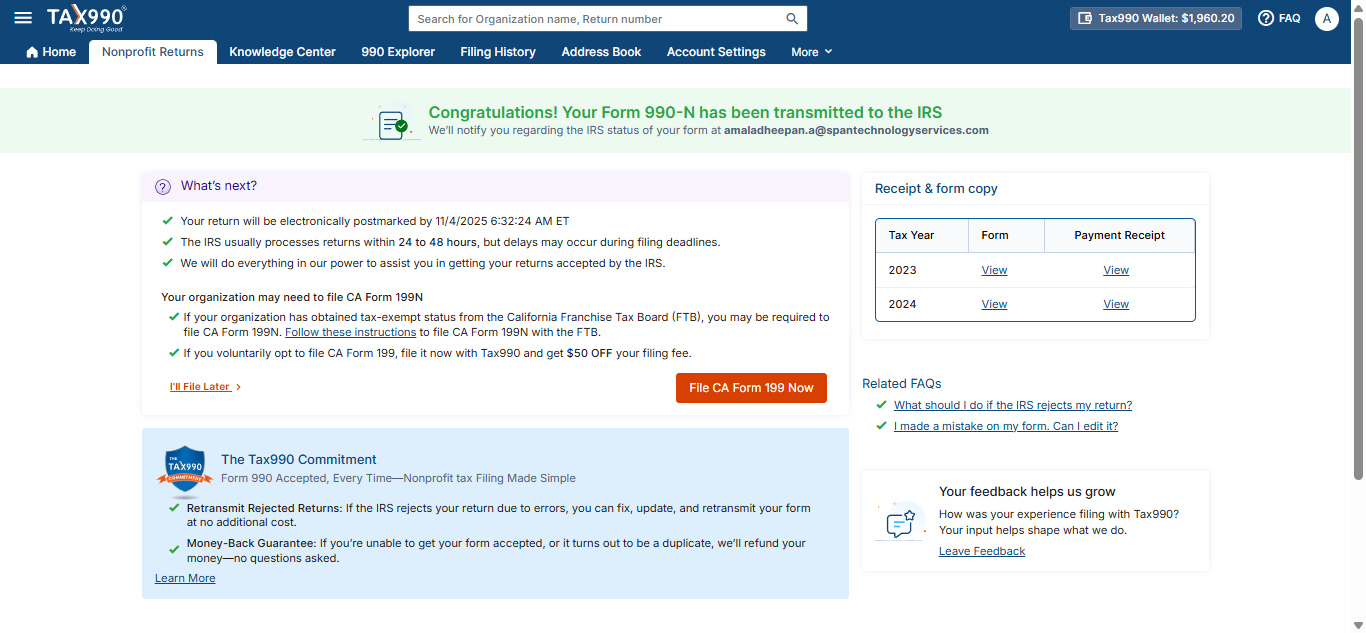

Once done, your form will be successfully transmitted to the IRS.

Need more help?

Get in touch with our dedicated support team Contact Us