How to file Form 990-PF with Tax990?

Follow the steps below to file Form 990-PF with Tax990:

Step 1: From the Tax990 website, enter your organization’s EIN in the search box and click ‘Search’.

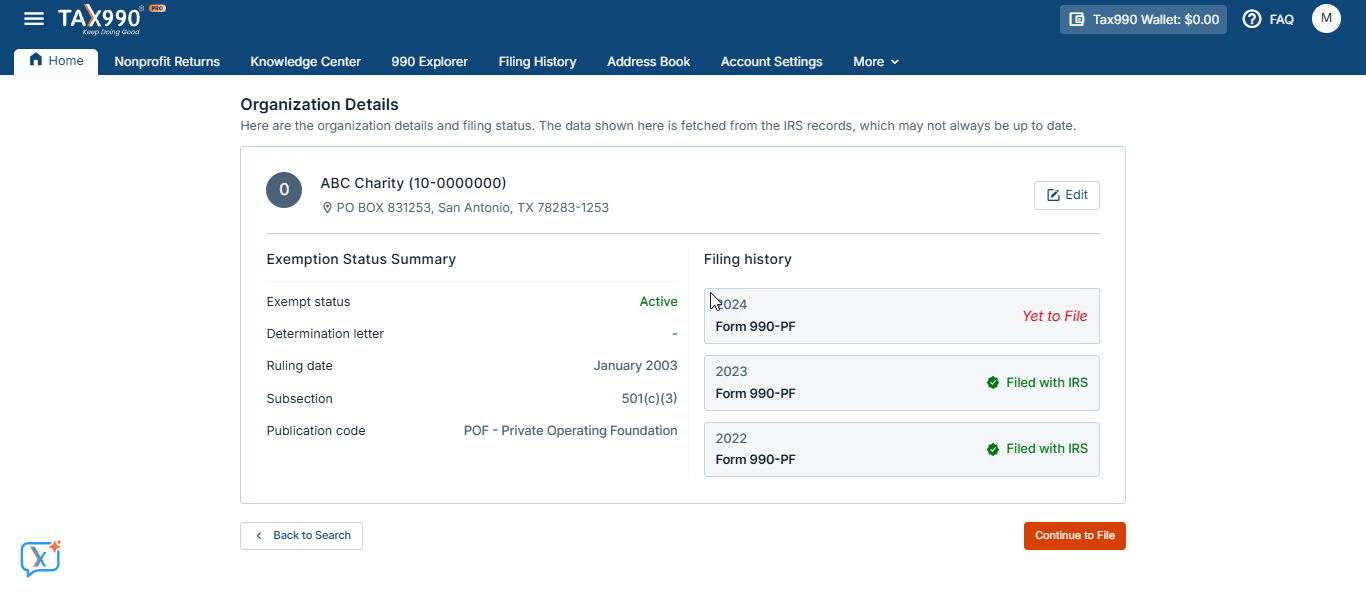

Step 2: You can find the organization’s details and the filing status of the EIN you’ve searched for (fetched from the IRS). Click ‘Start Filing’ to begin filing a new 990-PF return.

Step 3: Now, you’ll be prompted to log in or sign up. Enter your credentials to log in if you have an existing account, or create a new one to continue filing.

Step 4: You can view the summary of the organization and its filing status. Click 'Continue to File' to proceed with filing the returns.

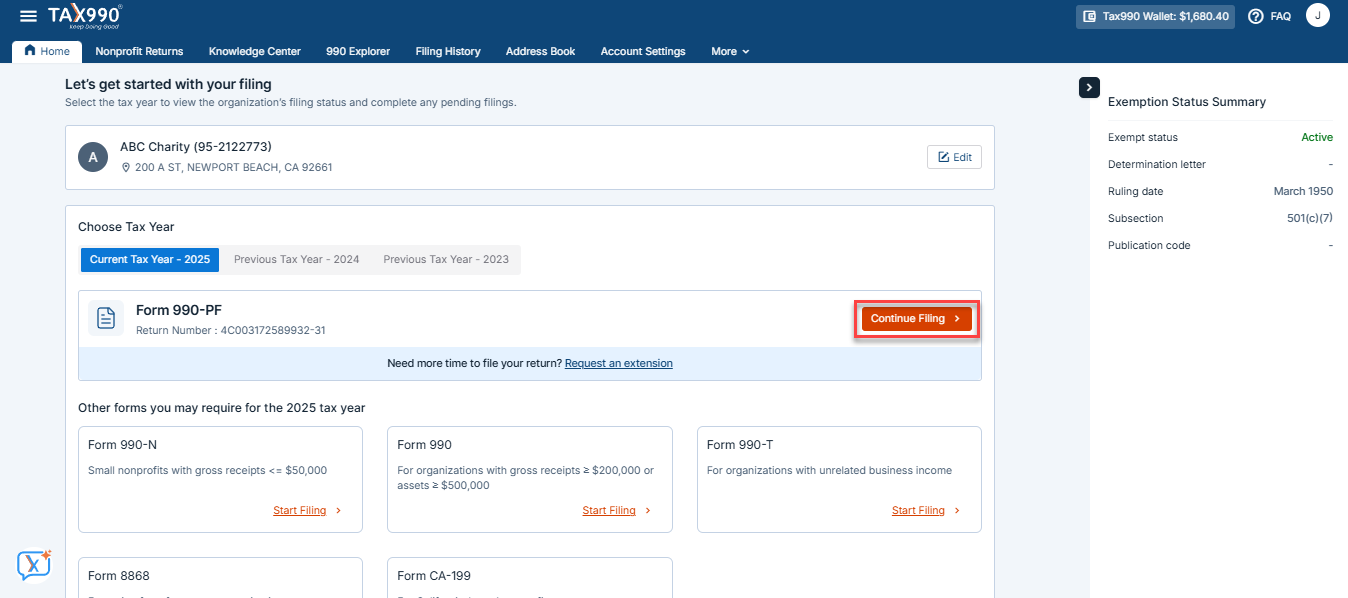

Step 5: Then, you can select the tax years you need to file for and click ‘Start Filing’.

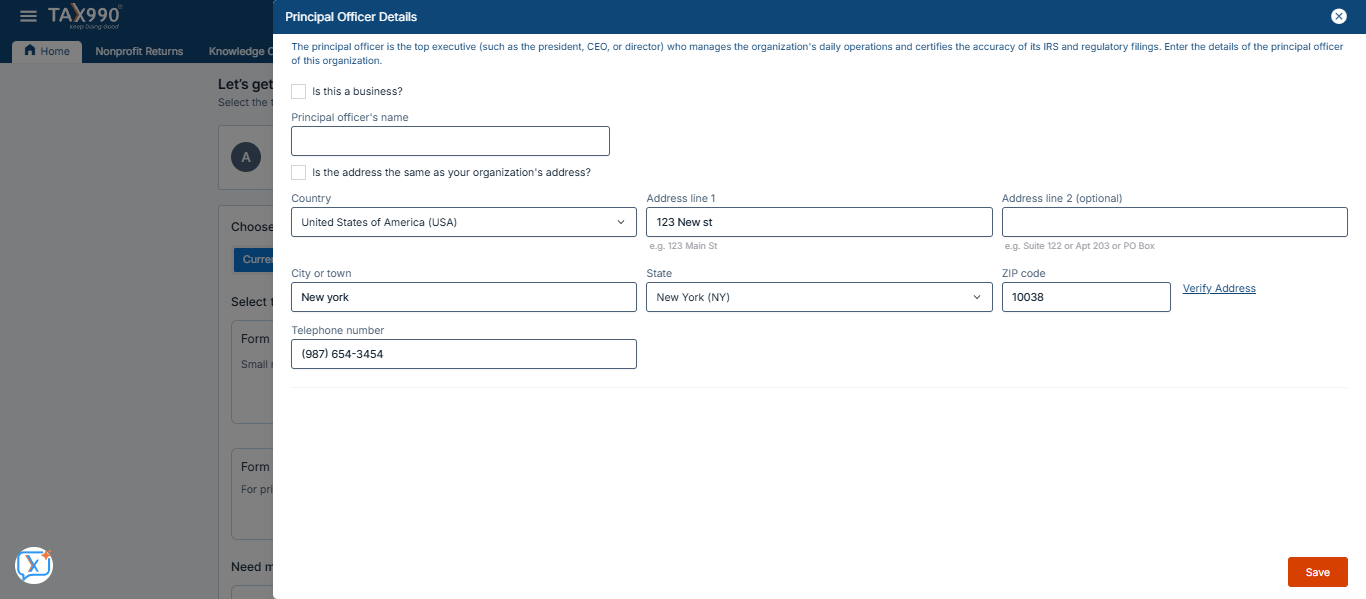

Step 6: Upon clicking, a pop-up will appear requiring you to enter the principal officer details. This will be automatically mapped onto your form.

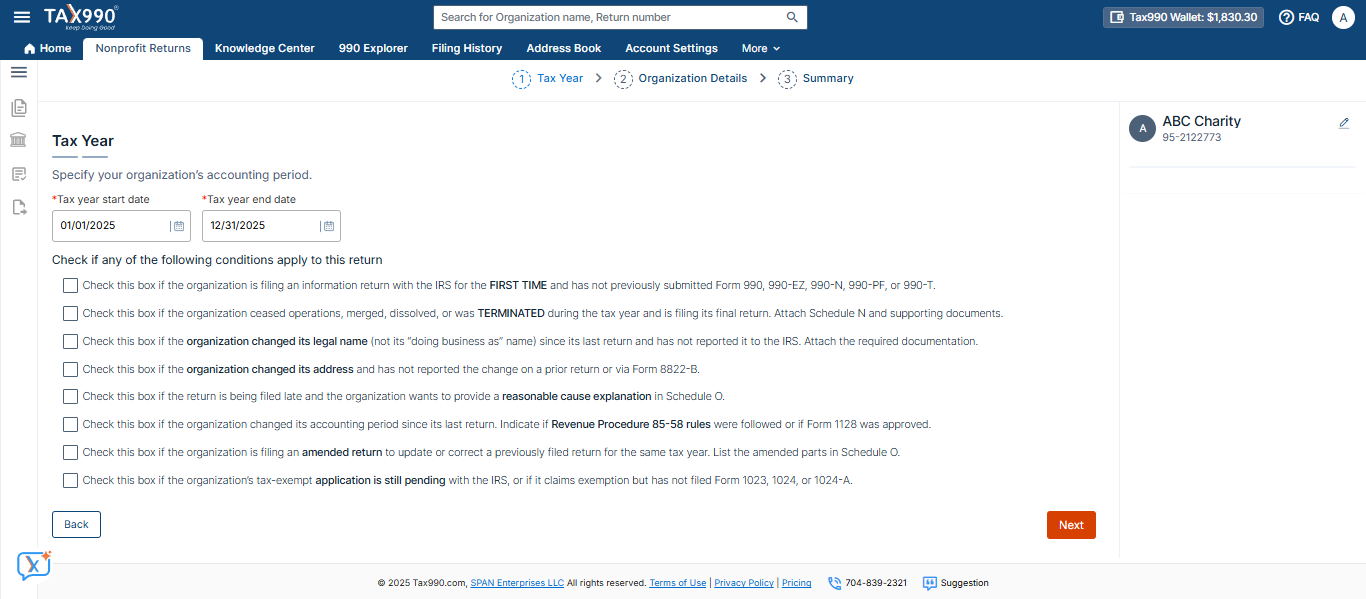

Step 7: Tax990 offers Form-Based and Interview-Based Filing options. Choose the method you prefer to fill out the form.

- Form-Based Filing: This method requires you to enter the details directly on the form. It is recommended for experienced filers.

- Interview-Style Filing: Here, you can complete the form by answering a series of questions. This method is recommended for new filers.

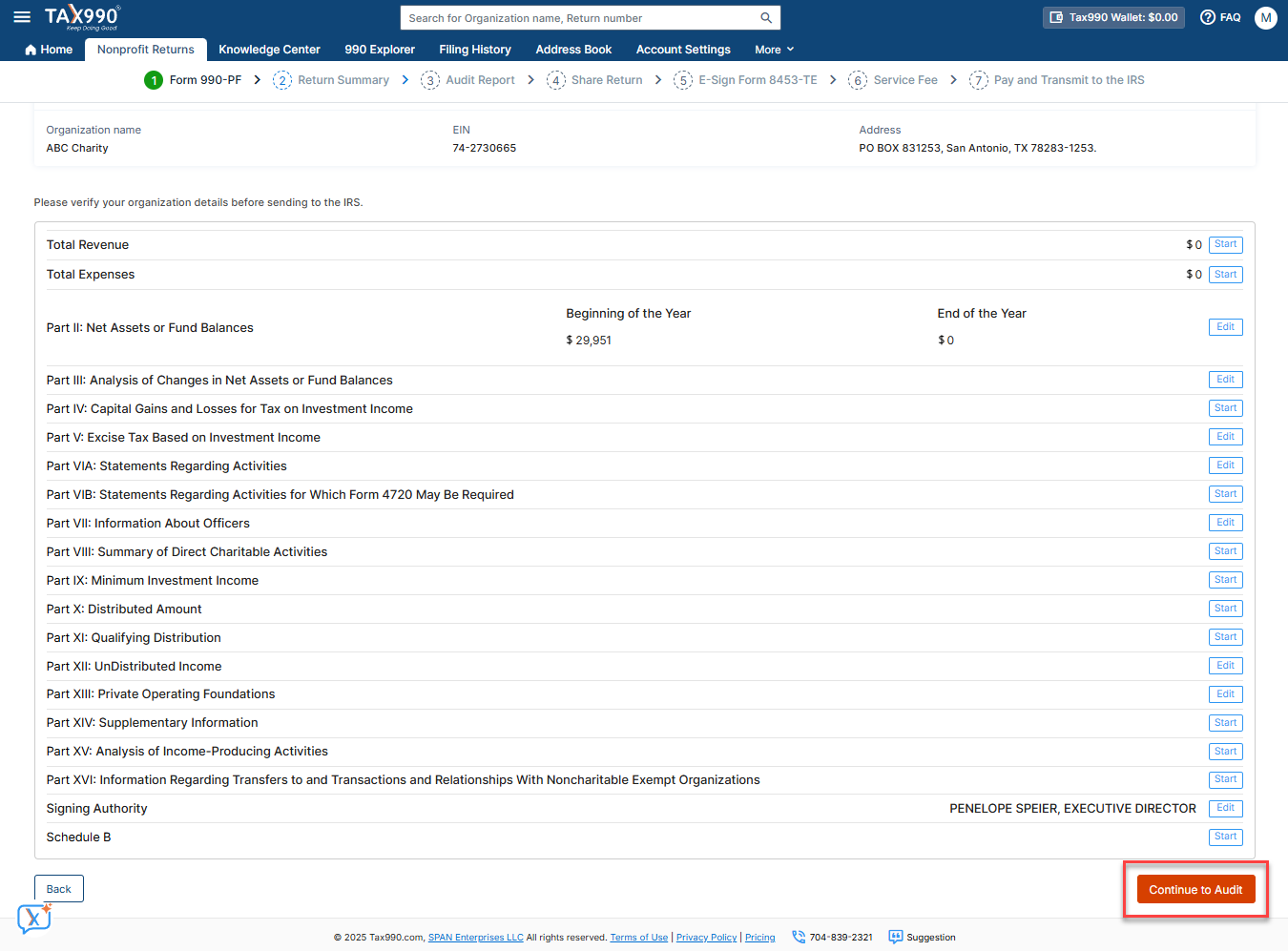

Step 8: Once you’ve completed the form, you’ll be directed to a summary page containing your return summary. Review the return and make any necessary changes. Once done, click ‘Continue to Audit’ to proceed.

Step 9: Now, you will be directed to the Audit Report page. Here, you can check for any errors in your submission. If any issues are identified, click ‘Fix Error’ to address the errors. Once you’ve made the necessary corrections, click ‘Next’ to proceed.

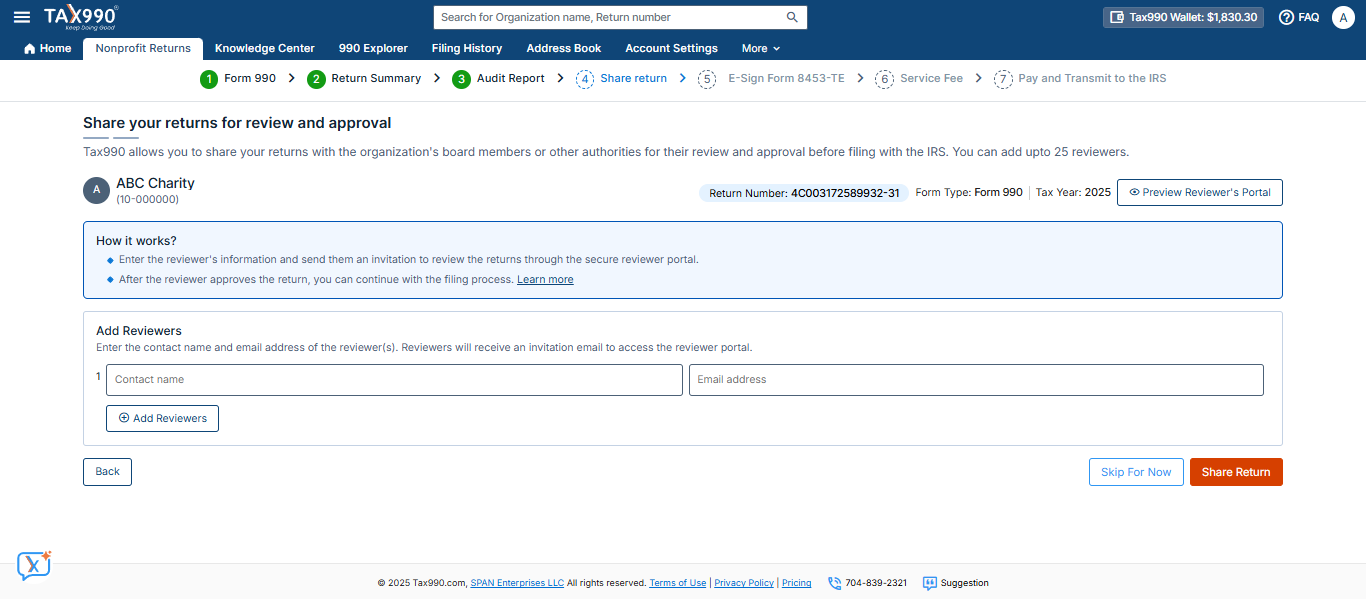

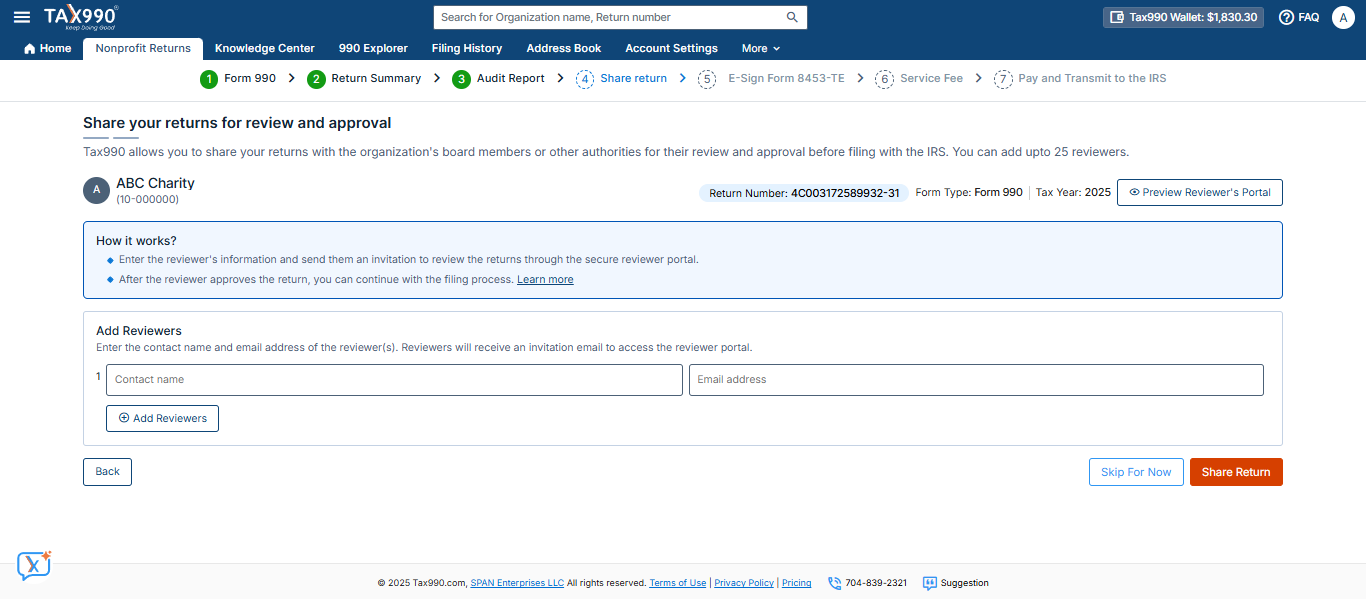

Step 10: Here, you can share the prepared return with your board members for review, as recommended by the IRS. To do so, add the reviewer details and send an email invitation. They will receive a link to a secure portal where they can review and approve your return. Once you’ve shared the form, click ‘Next’ to proceed.

Step 11: The IRS requires Form 8453-TE to be submitted with your 990-EZ return as an e-file signature. We will generate this form for you upon completing the return.

Click ‘e-Sign Form 8453-TE’ to add your signature or request an e-signature from an authorized signing authority of the organization. For more detailed information on how to share your return for review, click here

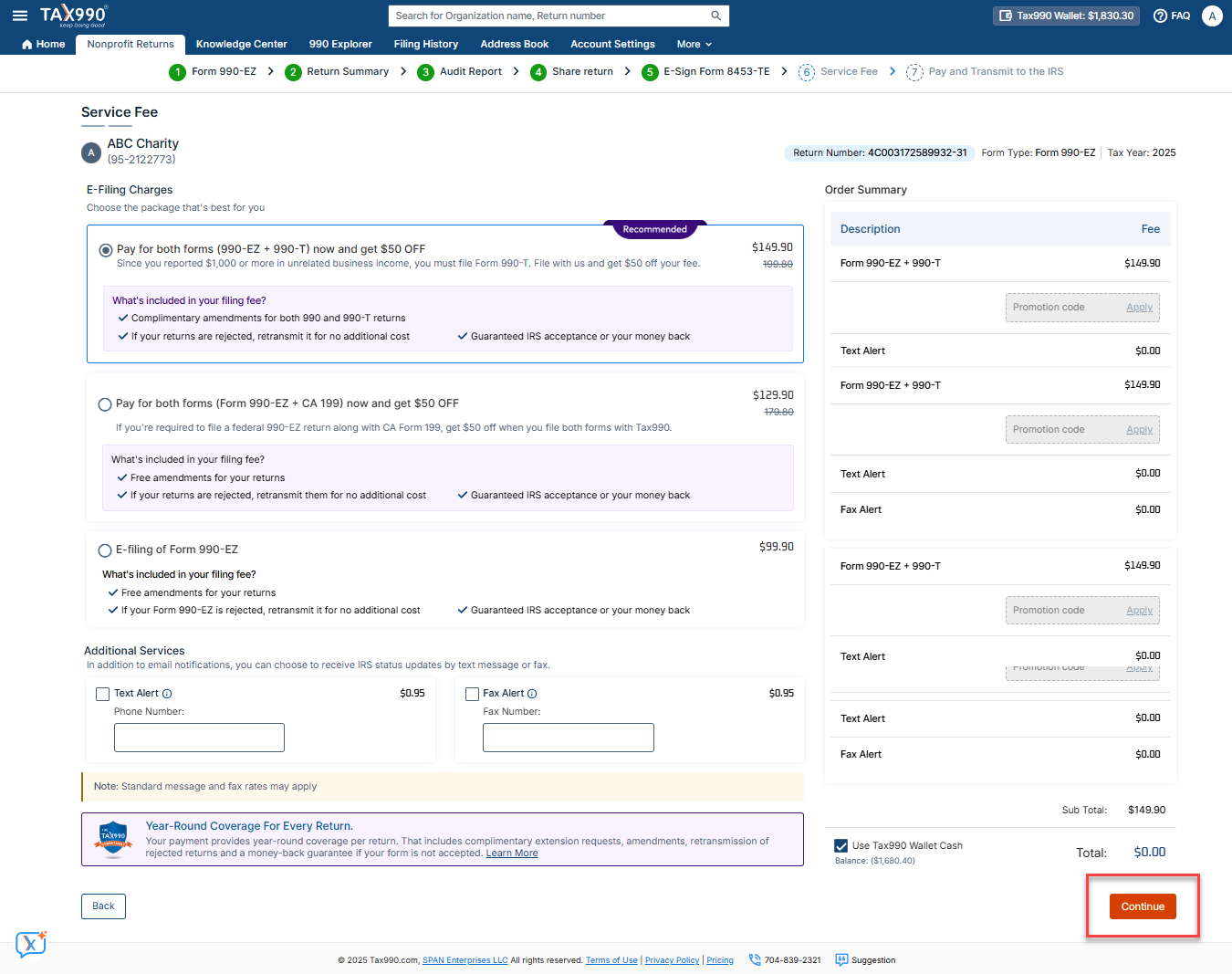

Step 12: Here, you can add the contact and fax number to receive alerts. Then, click ‘Continue’ to proceed.

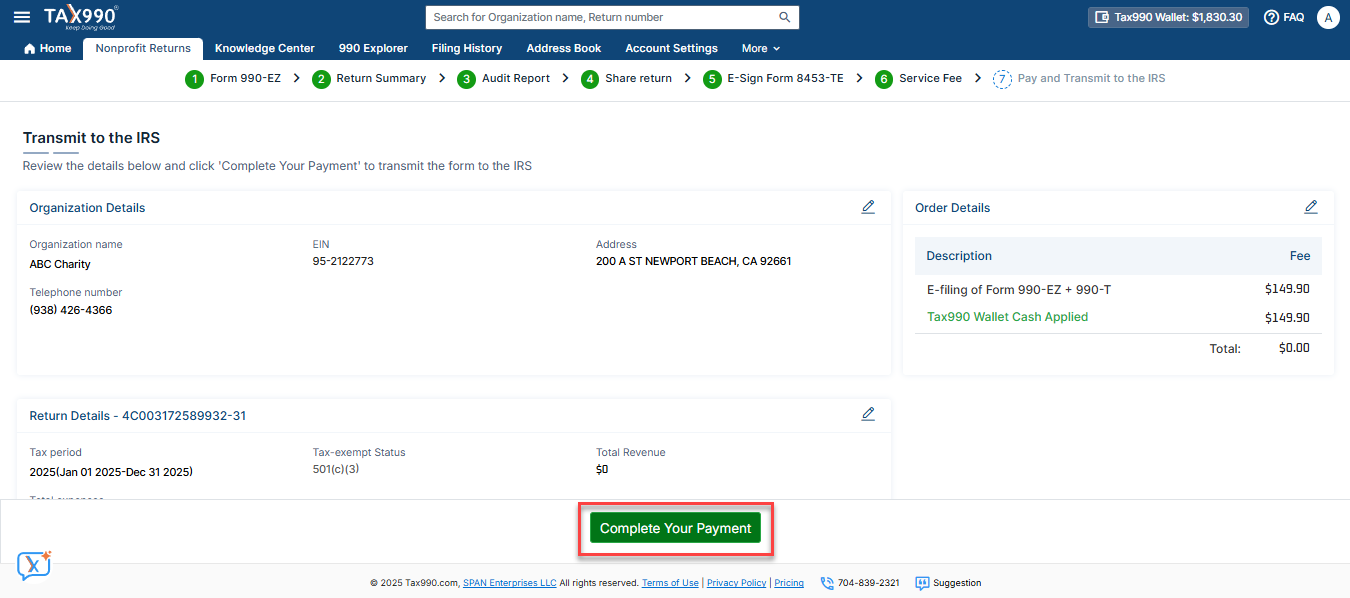

Step 13: On the summary page, review the final summary of your Form 990, and you can edit the details if needed. Click ‘Complete Your Payment’ to complete your Form 990 filing.

Once done, your form will be successfully transmitted to the IRS.

Need more help?

Get in touch with our dedicated support team Contact Us