Who is a Voting member, and how to report them on Form 990?

An individual in your organization who has voting rights to elect or appoint one or more members of the governing body is considered a Voting member. Therefore, if your organization has members, stockholders, or other persons with voting rights, you must report those members on your Form 990 return.

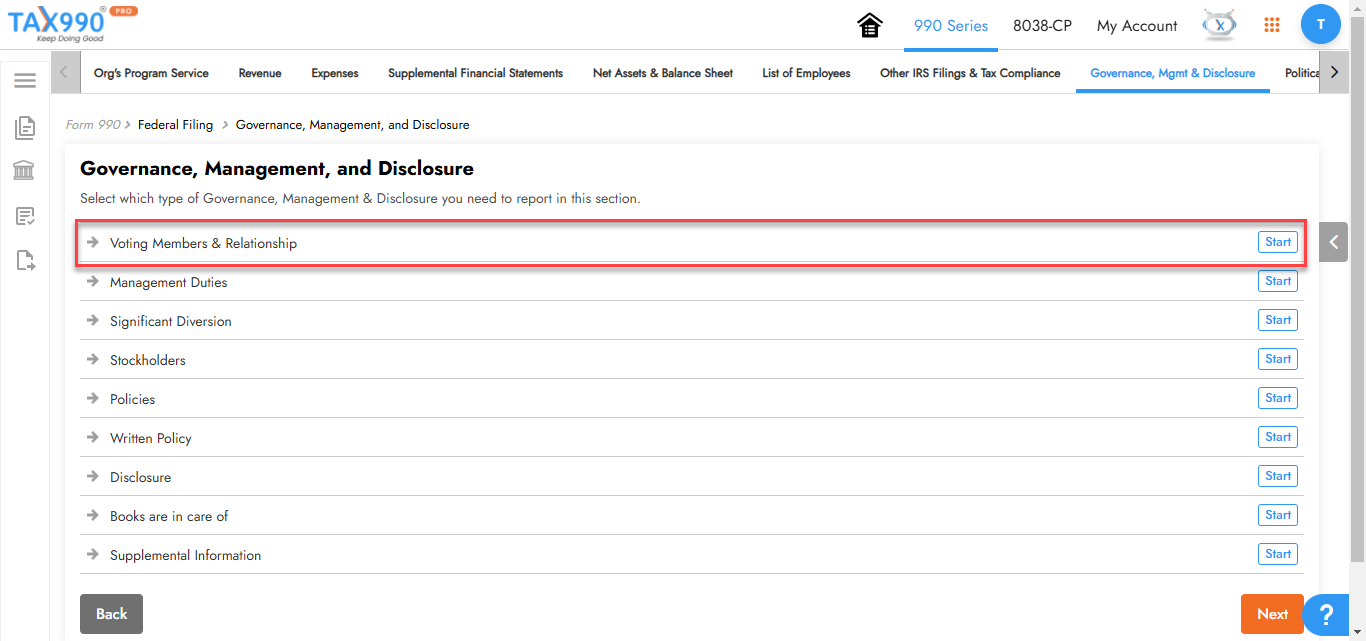

Reporting Voting Members

- If you choose Interview-based filing

Under the Governance, Management, and Disclosure section, click 'Start' in Voting Members & Relationship. You will be directed to the Governing Body and Management page. There, you can report the details of all your governing body members and independent members with voting rights

- If you choose Form-based filing

Navigate to Part VI, Section A - Governing Body and Management. Then, in line 1a, enter the number of voting members of the governing body at the end of your organization’s tax year.

If there are material differences in voting rights among members of the governing body or if the governing body delegated broad authority to an executive committee or similar committee, click on the icon on line 1a and provide an explanation.

In line 1b, enter the number of independent voting members of the governing body at the end of the organization's tax year.

Reporting Schedule O, Supplemental information

In addition to reporting the voting members, for each 'Yes' response the organization makes on lines 2 through 7b below, and for a 'No' response to lines 8a, 8b, or 10b in the section, it must describe the circumstances, processes, or changes made on Form 990 Schedule O, Supplemental Information (Form 990 or 990-EZ).

Need more help?

Get in touch with our dedicated support team Contact Us