What are the program service revenues that must be listed in Form 990-EZ?

Here is the list of contributions that must be listed under Line 1, Part I, Revenue, Expenses, and Changes in Net Assets or Fund Balances of Form 990-EZ

- Contributions received from various fundraising events and activities. Dinners, door-to-door merchandise sales, carnivals, and bingo games are some common examples of fundraising activities.

- Contributions received in the form of membership dues.

- Contributions received in the form of grants. Grants like these encourage filing organizations to continue their programs or activities.

- Contributions or grants received from governmental units

- Contributions received from other fundraising organizations. These contributions are made indirectly by the public through solicitation campaigns of federated fundraising agencies

- Contributions received from associated organizations. It includes the parent, subordinate, or any other organization with the same parent as the filing organization.

- Contributions received from commercial co-ventures. This type of contribution is generally received by allowing donors or individuals to use the organization's name in a sales promotion campaign, such as when the outside organization agrees to contribute 2% of all sales proceeds to the filing organization.

Reporting Contributions Received

- If you choose Interview-Based Filing

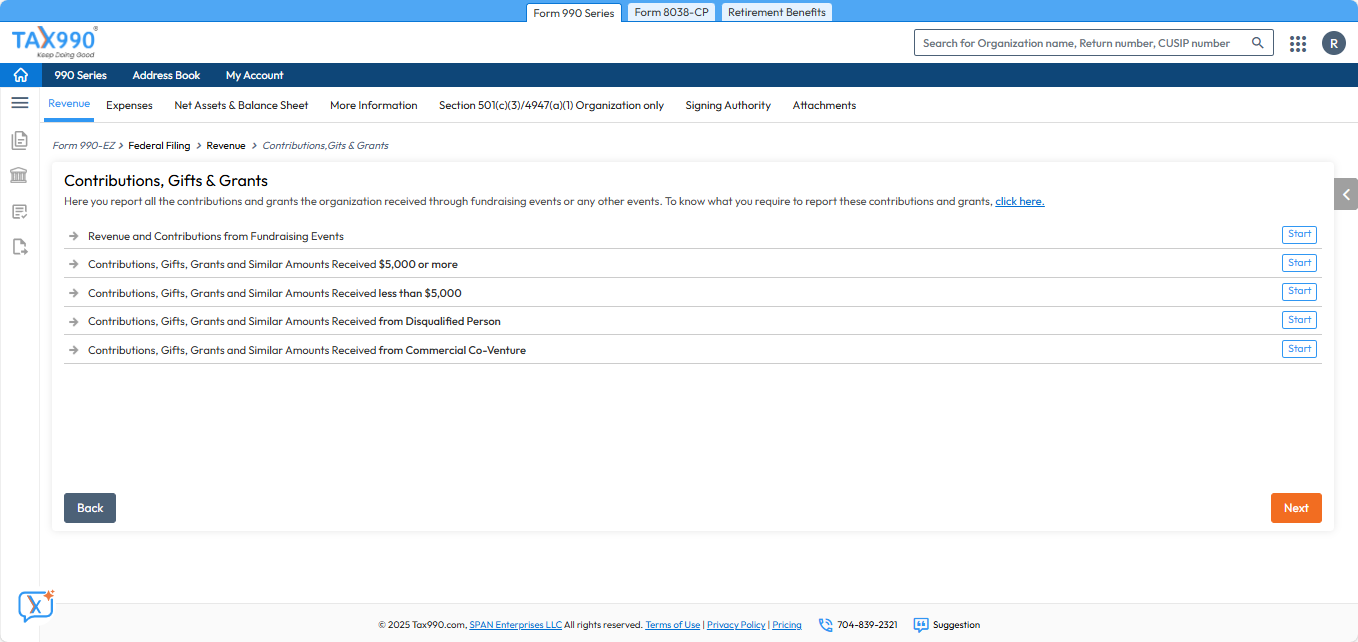

On the Contributions, Gifts & Grants page, answer the questions regarding the contributions and grants the organization received through fundraising or any other events.

- If you choose Form-Based Filing

Navigate to Part I, Revenue, Expenses, and Changes in Net Assets or Fund Balances. Then, in line 1, enter the Contributions, gifts, grants, and similar amounts received by your organization.

Need more help?

Get in touch with our dedicated support team Contact Us