Organization foundation code error [F990PF-902-01] - How do I resolve it?

IRS Error code: Form 990-PF: [F990PF-902-01]

Rejection Message:

If the "Exempt Operating Foundation" box is checked on Form 990-PF, the organization must have a foundation code "02" in the IRS e-file database. This code identifies your organization as an operating foundation, and it's necessary for proper filing.

What does it mean:

The IRS has rejected the return since the organization hasn't been designated as an exempt operating foundation under section 4940(d)(2). There's a possibility that the organization might have submitted the ‘Determination Letter’ to the IRS, which is pending approval, or the organization would have mistakenly chosen the option to claim an exemption.

To be classified as an exempt operating foundation, an organization must meet the below criteria.

- It must be a private operating foundation.

- It should have been publicly supported for at least ten tax years.

- The organization's governing body at any given tax year should have been made of individuals, amongst which less than 25% are disqualified individuals.

- The organization didn’t even have an officer who is a disqualified individual at any given tax year.

- The organization must have obtained the determination letter confirming its exempt operating foundation status. This determination letter can be obtained by submitting Form 8940.

Action Required:

- If the organization has submitted its Determination Letter to IRS, they check with the IRS on its status before claiming an exception on excise tax. They can reach out to the e-help Desk Toll-Free Number 1-866-255-0654.

- If the option to claim an exception was opted by mistake, then the other option, "NO," can be chosen, and the form is re-transmitted to the IRS again.

Follow the status to correct the organization's choice of exempt status:

- From the home page, select the organization and the tax year.

- You need to click on the Rejected by the IRS button for the rejected return to find the list of errors. Then, click the Fix Me button to resolve the rejection error.

- Based on the filing type you have chosen, you will be navigated to the corresponding page.

Interview-based filing - You'll be directed to the Type of Organization page. Under "Domestic Exempt Operating Foundations Described in Section 4940(d)(2)", select NO.

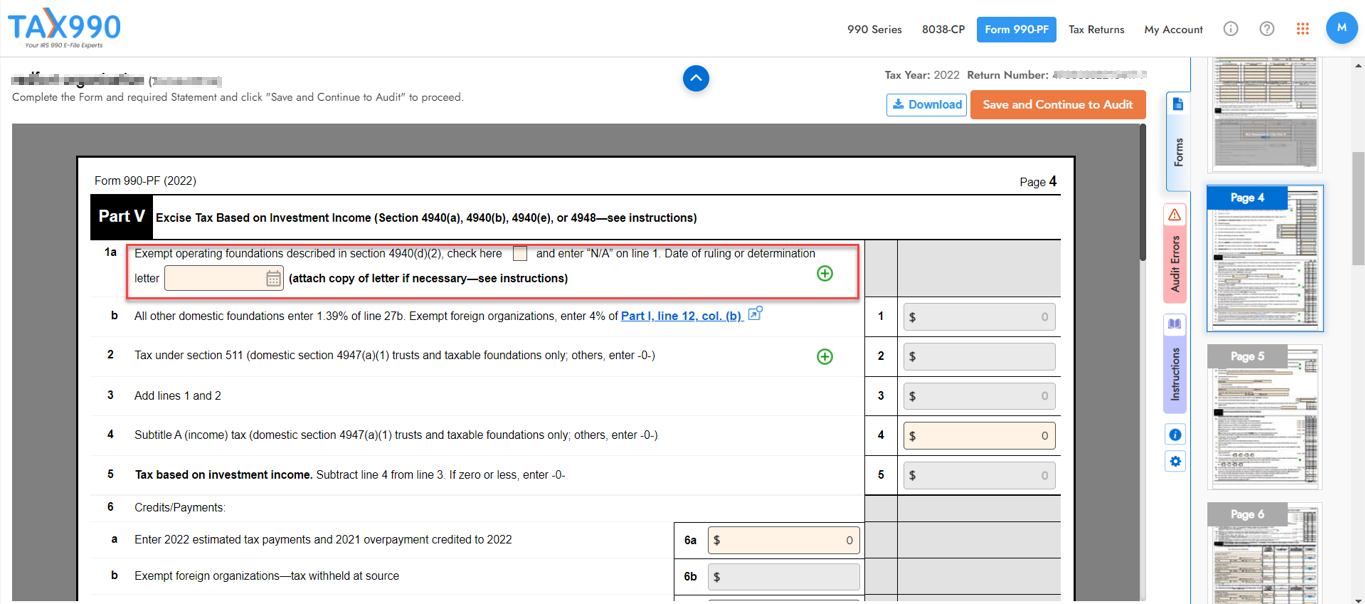

Form-based filing - You'll be directed to Part V, Line 1a of Form 990-PF. In the line, uncheck the box and leave the Date of the ruling field blank.

- Follow the subsequent steps as prompted.

- Review the details, and click the Transmit button to re-transmit your return to the IRS at no additional cost.

We'll keep you informed on the status of the return once we hear back from the IRS.

For any further assistance, we recommend contacting the IRS e-Help Desk Toll-Free Number 1-866-255-0654.

|

Retransmit Rejected Returns for Free

|

Need more help?

Get in touch with our dedicated support team Contact Us